10+ Alternatives to Wise for business banking and foreign exchange

By

Bound Editorial Team

If you're involved in international business, you know that foreign exchange conversion and hedging are essential components of managing your finances. However, you might also know that finding a reliable and efficient platform is challenging.

While Wise is a popular choice for many, it's always a good idea to explore alternative options to ensure you're making the best decision for your business. In this article, we will delve into the world of foreign exchange services and discuss the best alternatives to Wise for both conversion and hedging.

Why Foreign Exchange Conversion and Hedging?

Before we dive into the alternatives, let's take a moment to understand the importance of foreign exchange conversion and hedging. In today's global economy, exchanging one currency for another is unavoidable when conducting cross-border transactions.

Foreign exchange conversion is a cornerstone of international trade and investment. As a necessary part of buying and selling goods and services in different currencies, it’s used by businesses to expand their market reach and diversify their revenue streams. Without efficient foreign exchange services, businesses would face significant challenges in managing their financial operations across borders.

Foreign exchange hedging is a risk management strategy to limit potential losses caused by volatile currency fluctuations - see our introductory article here. Any business that buys and sells in other countries, sends money overseas, or has staff, or business partners abroad are exposed to foreign currency risk. This risk can also affect investors with foreign assets in their portfolios.

Consequently, foreign exchange services that not only facilitate conversions but also offer various hedging options are highly desirable for businesses to protect themselves from foreign exchange risk.

Key Features to Look for in a Foreign Exchange Service

When considering alternatives to Wise, it's important to look for specific features that align with your needs. These may be anything from transparent fees and fair exchange rates to excellent customer service. Here’s a list of the most important features you can consider in a foreign exchange service:

Transparency - clear and upfront information about exchange rates, fees, and any other charges ensure that you understand what you are getting into and helps to prevent those pesky hidden fees.

Fast transactions - often transactions need to be made quickly to take advantage of favourable exchange rates or to meet urgent financial needs.

Favourable/Fair exchange rates - pretty self explanatory, the better the exchange rate, the more bang for your buck.

Security - Foreign exchange transactions involve the transfer of money across borders, making security paramount.

Multi-currency wallets - enables customers to hold and manage various currencies within a single account, providing convenience and flexibility.

User-friendly interface - seamless user experience and intuitive navigation to perform transactions, monitor accounts and access relevant information.

Excellent customer service - constant support to solve all your issues, and improves customer relations.

Compatibility/Ease of integration - easy integration with your existing systems saves the hassle of technical challenges.

In addition to FX conversion, businesses that value risk management may also want to look into more advanced features to help mitigate risks associated with currency fluctuations. By offering hedging solutions, market insights and more, these services can provide a layer of protection against unpredictable market insights. This risk management aspect is particularly valuable for businesses operating in volatile regions or dealing with multiple currencies.

Advanced features:

Hedging solutions - products such as forward contracts, options, and swaps, foreign exchange services enable customers to mitigate the impact of exchange rate fluctuations on their finances or international transactions, providing stability and predictability in uncertain market conditions.

Real-time market insights - access to up-to-date market data, trends, and analysis enhances customers' ability to make informed decisions and optimise their foreign exchange strategies.

Automated hedging strategies - leveraging technology to manage their currency risk more efficiently by reducing the need for manual intervention and ensuring timely execution of hedging activities.

Customisable reporting tools - comprehensive and customisable reports on transaction history, account balances, risk metrics, and other relevant data, foreign exchange services empower customers to gain insights into their currency exposure, assess the effectiveness of their hedging strategies, and meet regulatory or compliance requirements.

Choosing a foreign exchange service provider that offers a comprehensive suite of tools and resources can streamline your currency management processes, empower you to make informed decisions, and optimise your financial performance in the global marketplace.

Exploring Wise as a Foreign Exchange Platform

Wise, formerly known as TransferWise, was founded in 2011 by Taavet Hinrikus and Kristo Käärmann, two friends who were frustrated by the high fees charged by banks for international money transfers.

Wise has gained immense popularity in recent years, thanks to the platform’s competitive rates and transparency. This has garnered the trust of millions of users worldwide, making it a favourite among individuals and businesses alike. However, with the market constantly evolving, a diverse range of platforms now vie for your attention, so it’s important to weigh the pros and cons, and carefully choose which one is best for you.

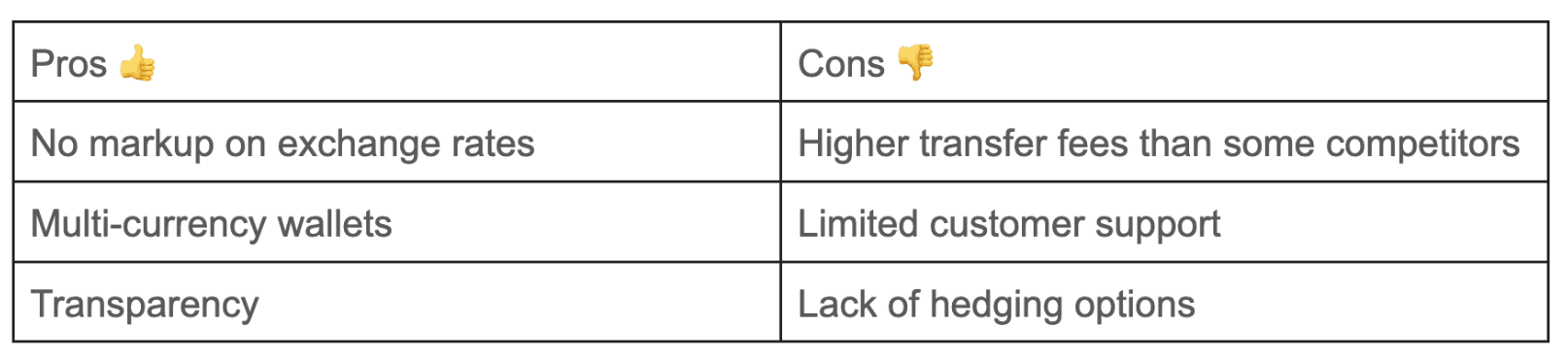

Pros of Using Wise

One of the major advantages of Wise is its low fees compared to traditional banks. Additionally, the platform allows you to hold and manage multiple currencies in a single account, providing convenience and flexibility.

Furthermore, what sets Wise apart is its commitment to transparency. Unlike many traditional financial institutions, Wise displays the real exchange rate, ensuring that customers know exactly how much they are paying in fees. This level of openness has helped build a loyal customer base that values honesty and integrity in their financial transactions.

Cons of using Wise

Despite the impressive features, there are a few downsides to consider. At the time of writing this article, Wise has access to 40 currencies in 160 countries. However, Wise's exchange rates may not always be the most competitive, and the transfer speed can vary depending on the currencies involved.

Some users have expressed concerns about accounts being deactivated, as well as availability of customer service. If a branch network is important for you, then that’s something to consider as well since Wise does not have a face-to-face option.

Perhaps the biggest drawback with Wise is their limited hedging capabilities. As a platform focused on efficient spot currency exchanges, it has no specific features for hedging currencies. Businesses seeking to minimise currency risk may find Wise lacking in this regard.

All in all, Wise continues to innovate and adapt to meet the needs of its users and remains a top choice for many businesses looking for a reliable and cost-effective foreign exchange platform.

Top Alternatives to Wise for Foreign Exchange Conversion

Now that we have explored Wise, let's dive into the top alternatives for foreign exchange conversion. Here’s a quick breakdown of each one, with some of their unique features and who they might be best suited for:

OFX: Originally known as OzForex, OFX is an Australian-based company offering international money transfers and currency exchange. Since its launch in 1998, it has grown into one of the world's largest online foreign exchange companies. OFX provides a blend of cutting-edge technology and excellent customer service to offer better deals for both corporate and private clients. It operates globally, facilitating secure and fast money transfers in over 50 currencies to more than 170 countries.

Used by: Businesses with international clients across numerous countries.

Western Union: Western Union is a global leader in cross-border, cross-currency money movement with a rich history dating back to 1851. Initially founded as a telegraph company, it has since evolved into a financial services corporation offering money transfers, bill payments, and money orders among other services. Today, Western Union operates in over 200 countries and territories with the convenience of multiple sending and receiving options including a network of hundreds of thousands of agent locations worldwide.

Used by: Businesses seeking payments to people with no bank accounts, remote areas and speed over urgent transfers.

Revolut: Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut has evolved into a global banking alternative, offering a range of financial services including bank accounts in GBP and EUR, debit and credit cards, currency exchange, stock trading, and cryptocurrency exchange.

Used by: Businesses based out ot Australia, Ireland, France, Romania, the UK, Lithuania, and the US.

PayPal: PayPal is an American company operating a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders. The company operates as a payment processor for online vendors, auction sites, and many other commercial users, charging a fee for benefits like one-click transactions and password memory. PayPal is widely recognized for its buyer protection and fraud prevention measures, making it one of the most trusted names in online commerce.

Used by: Businesses seeking payment processing solutions with multiple features and capabilities.

HSBC: HSBC is a British multinational investment bank and financial services holding company. It is one of the world's largest banking and financial services institutions, serving customers worldwide. The company's offerings include corporate and investment banking, as well as a variety of financial services.

Used by: Businesses looking for the best personal and business features.

Payoneer: Payoneer is a financial services company that provides online money transfer and digital payment services. Account holders can send and receive funds into their bank account, Payoneer e-wallet, or onto a reloadable prepaid MasterCard debit card that can be used online or at points of sale. The company specializes in facilitating cross-border B2B payments. It provides cross-border transactions in more than 150 local currencies, with its services used by global brands such as Airbnb, Amazon, Google, and Upwork.

Used by: Businesses based out of the following geographies: US, EU, the UK, Australia, Hong Kong, Singapore, Japan, Canada, and UAE.

Airwallex: Airwallex is a global financial technology company that specializes in offering comprehensive financial services and software solutions, particularly for businesses engaging in cross-border operations. Established in 2015 in Melbourne, Australia, and now headquartered in Singapore, Airwallex has grown rapidly, extending its reach to various international markets including the United States, European Union, and several Asian countries. The company provides a wide range of services including payments, treasury, spend management, and embedded finance, all designed to facilitate global business operations through its proprietary banking network and APIs.

Used by: For businesses seeking to better manage employee expenses.

Best Alternatives to Wise for Hedging

While foreign exchange conversion is essential for most businesses, hedging can offer additional protection against potential currency risks. If hedging is a priority for your business, you’re going to want to explore alternatives to Wise that offer robust hedging options.

Traditional Banks

Many banks like HSBC, Lloyds, Barclays, and many more, offer FX risk management and hedging services. A big benefit is that banks have dedicated teams or departments specialising in foreign exchange services. The expertise and guidance provided by their professionals can be helpful, especially if you’re inexperienced at managing FX risk.

Banks also typically offer a variety of hedging products tailored to different risk profiles and needs, including forward contracts, options, swaps, and other hedging instruments, providing flexibility in managing FX risk. A word of caution though, these standardised hedging products may not fully align with your specific risk exposure and hedging requirements.

The biggest downside, however, is that banks often slap on higher fees and margins on FX transactions and hedging products compared to alternative providers out there. Plus, FX hedging transactions with banks can get pretty time-consuming and complicated. You might find yourself stuck with lots of paperwork and complex processes. This can be quite daunting for companies with limited resources and expertise.

Take a look here to see how we compare to traditional banks.

Forex Brokers

Another alternative to consider are Forex brokers, companies that specialise in FX conversion and hedging. You might get better rates by speaking with them as compared to standard bank rates. However, some caution is needed here since if you’ve been around the block, you’ll know the business model some brokers follow: You get a fantastic introductory price (potentially even a loss leader), then gradually, trade by trade, the rates start slipping.

Brokers can be a good choice for businesses with more complex FX needs. The word complex is the key here, since to take advantage of all the complexity, a business would typically have complex needs and a dedicated team of people to manage the relationships (regular emails, phone calls, etc.) and transactions with the brokers.

Forex brokers like Alpha, Corpay, TorFX, Smart Currency Business, Lumon and Universal Partners offer a range of services, from spot trades to forward contracts and options.

Specialised Fintech Companies

Last but certainly not least, specialised fintech companies are an alternative to traditional banks, online exchanges and FX Brokers for hedging.

These companies leverage technology to offer innovative and cost-effective solutions.

Companies like Bound (👋), Pangea, Alt21 and Hedgeflows are playing in this space.

Compared to their traditional counterparts, these fintech firms tend to be easier to use, have higher degrees of flexibility, and lower fees.

Some of them, not naming any names (👋), also provide the ability to change anything at anytime - with just a few clicks and no hidden fees..

Making the Right Choice: Factors to Consider

Assessing Your Foreign Exchange Needs

Start by assessing your specific foreign exchange requirements. Here are some questions that can be helpful to ask yourself first:

Do you primarily need conversion services or hedging options? Or Both?

Are you dealing with specific currencies or conducting transactions in multiple regions?

How complex are your needs and do you need access to an FX broker/bank?

Do you have the resources to manage relationships with a FX broker/bank or do you prefer a self-serve and online solution?

By identifying your needs, you can narrow down the alternatives that offer the best solutions for your business.

Final Considerations!

Finally, consider the scalability of the foreign exchange service you choose. As your business grows and expands into new markets, you'll want a provider that can accommodate increased transaction volumes and offer support for a broader range of currencies. Scalability is key to ensuring that your foreign exchange solution remains effective and efficient in the long term.

Moreover, it’s best not to overlook the importance of data security and compliance when selecting a foreign exchange provider. With the increasing prevalence of cyber threats and regulatory requirements, ensuring that your chosen service adheres to stringent security protocols and regulatory standards is paramount. A robust security framework and adherence to industry regulations can safeguard your financial transactions and protect sensitive data from potential breaches.

By taking the time to research and explore alternatives to Wise, you can ensure that you make an informed decision that benefits your business in the long run. Remember, a reliable and efficient foreign exchange service can have a significant impact on your financial success, so choose wisely!